Leicester's Leading Mortgage Advisors

Let us put you in touch with one of our financial experts who will give you impartial advice and help you find suitable products for you.

Expert service

Highly Rated

No credit search conducted

Why use us?

From the information you provide to us, our experts will search the market and find the most suitable products for you. If you are happy with the product on offer, we will handle all the necessary paperwork for you, including any relevant applications, to ensure that everything runs smoothly for you.

Quick service

From just a few minutes completing some basic information, we will quickly search for suitable financial products for you.

Expert advice

We’ve helped thousands of customers secure financial products and service so you know that you are in capable hands.

Reduced stress & time saving

Choosing the right financial product is time consuming and can be stressful, so remove much of this by putting it in the hands of one of our financial experts.

Reliable service

Whatever type of financial product or service you are looking for, our service is reliable and always matched to your own personal circumstances.

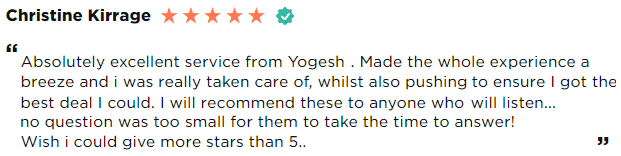

Leicester - Yogesh Parekh

Finance Advice Centre Leicester is the newest franchise to open. Director Yogesh Parekh has been with the Finance Advice Centre working in the Head Office. Located in the Stoneygate area of Leicester, Yogesh and his team will be here to help you!

Yogesh has had over 20 years’ experience working in the finance industry. Having worked at various banking institutions like NatWest, Halifax and Alliance and Leicester, Yogesh had started learning the trade he now loves. The biggest part of that is giving great customer service and understanding their needs. Yogesh gets great satisfaction out of a happy customer and goes the extra mile to achieve a fantastic result.

Yogesh joined Everyday Loans in 2007 and worked up the ranks. Working with Everyday Loans he really understood that each customer was unique and had different needs. Client satisfaction propelled Yogesh into being a director of his own Finance Advice Centre franchise to help customers’ achieve their dreams of being homeowners. He and his team are looking forward to forging new relationships with customers and understanding their needs and hopefully bringing a smile to their faces.

Get in touch

Former Royal Oak

Leicester Road

Wigston

LE18 1JX

0116 497 9999

Want to join the team?

Interested in joining the Leicester franchise? We are currently looking for advisors to join. If you’re interested feel free to get in touch here.

Where to Find us

Some of the types of mortgages we can help you with

First-time buyers

There is a lot of exciting potential for first-time buyers in Leicester looking for a new home. You may have spent years scrimping and saving up your deposit and are now ready to make that first rung on the property ladder. If that applies to you, the next step is to find out how much you might be able to borrow for your mortgage to give you an indication of the type of property you can afford to buy. When you start looking for mortgages in Leicester, it is prudent to compare the best deals. If you’re new to first-time buyer mortgages, avoid the temptation to jump into the first option available to you in order that you get the best deal. Our mortgage advisors can help you with that.

Remortgaging your property

There are a number of reasons you might decide to remortgage your home including:

- Your current deal is soon to expire

- Mortgage overpayments

- Increased property value

- You are on a higher interest rate

- Releasing of equity in the property

If you need any help with remortgaging it is advisable to speak to a mortgage broker in Leicester. One of our experts at Finance Advice Centre will be able to answer any questions you have and ensure you get the best remortgage deal.

Buy-to-let mortgages

Buy-to-let mortgages are for those who intend to buy property as an investment rather than a home to reside in. If you have plans to rent out a new property, most lenders will prefer you not to finance the purchase with a residential mortgage but instead will offer you buy-to-let mortgage options.

Unlike most residential mortgages, buy-to-let are usually offered on an interest-only basis. This means that your monthly payments will only cover the interest on your mortgage and not the capital itself.

Right to Buy mortgages

If you are a tenant in property you rent from the local authority, you may be able to buy your property from your landlord at a discounted rate. The Right to Buy scheme gives qualifying tenants discounts on properties they have rented in for a number of years. The amount of discount available depends on the type of property you live in. Those living in a council house could be eligible for a 35% discount if they have been a tenant for between three and five years. After five years the discount goes up by 1% for every extra year as a tenant, up to a maximum of 70%. If renting a council-owned flat, a 50% discount could be available to those who have lived there between three and five years, and for each extra year after that, the discount rises by 2% up to a maximum 70% discount.

Commercial Mortgages

Business loans up to £25,000 are unsecured, but for greater amounts, lenders require security so they can reduce the risk to themselves – this is where a commercial mortgage comes in. A commercial mortgage typically lasts from 3 to 25 years and you can usually find a 70-75% mortgage. There are two types of mortgage loan for commercial properties, owner-occupier mortgages and commercial investment mortgages. An owner-occupier mortgage is used to buy property that will be used as trading premises for a business whereas a commercial investment mortgage is used for property that is intended to be rented out.

For more information about mortgages in Leicester get in touch with the Finance Advice Centre today. We also offer advice about self employed, moving home, professional, and Lifetime mortgages. Our team has specialist knowledge that can benefit you whether you’re completely new to the mortgages or have prior knowledge. So, if you are looking for a mortgage advisor in Leicester that can give you the assistance you need to get your mortgage application accepted, we are on hand to help.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Our approach - and how we do it

Enquire

We love speaking with our clients. Either give us a call or fill in one of our contact forms. Remember, we love a challenge!

Discuss

One of our Advisors will then find out what you’re looking to do, discuss your options and answer any questions you may have.

Relax

Your Advisor will find the best option for you and help arrange things. You then sit back and relax while we do the rest.

Ready to assist you.

Choosing a financial product or service, such as a mortgage, remortgage, loan or insurance can be daunting and your choice is a decision you need to get right. For this reason, it is vital that you get impartial advice from competent and qualified advisors. Whether you are a first-time buyer, looking to remortgage, hoping to remortgage or even buy a property to let, needing a loan or insurance this is where our advisers excel.

Be reassured that our aim is to guarantee reliable financial advice appropriate to any individual that makes contact with us. Through our network of contacts, we have access to thousands of financial products, from mortgages to loans to insurance, so we are confident that we’ll find one to suit you.

See what our customers think ...

Emma Griffiths

I would highly recommend the mortgage advice service Alice Hale was amazing throughout she is a credit to your organisation and helped us secure our dream home

Emma Weaver

We had a long journey buying our first home together and recent pandemic events didn’t help matters. Every step of the way, our advisor Steve was supportive, positive and we had every confidence in him. He was able to arrange a good deal for us and we were able to move into our dream house this autumn.

Joanne Widdowson

I used George from the finance advice centre to get my mortgage, and he was nothing but amazing! Talked me through every step, always easy to get hold of ! And got me a brilliant product I would highly recommend him, just brilliant 5 stars from me

What a Fantastic Service from start to finish. Great customer support from Ben Patten & Joe Frayne, superb product knowledge and exceptionally responsive to emails/calls, we can 100% recommend the Finance Advice Centre Ltd , they got us a great deal on a mortgage with suited life insurance, especially during this very difficult Covid 19 time ……

From start to finish, Greig and Emily were very helpful with our mortgage application. The advice Greig gave us was very clear and informed. They were always available either by phone or email to answer any questions we had. The whole process was made a lot easier because of the work they did. Would thoroughly recommend

Let us do the work of finding your mortgage

We’ll put you in touch with impartial advice from an expert mortgage advisor who will help secure you the best mortgage deals available.