Derby's Leading Mortgage Advisors

Let us put you in touch with one of our financial experts who will give you impartial advice and help you find suitable products for you.

Expert service

Highly Rated

No credit search conducted

Why use us?

From the information you provide to us, our experts will search the market and find the most suitable products for you. If you are happy with the product on offer, we will handle all the necessary paperwork for you, including any relevant applications, to ensure that everything runs smoothly for you.

Quick service

From just a few minutes completing some basic information, we will quickly search for suitable financial products for you.

Expert advice

We’ve helped thousands of customers secure financial products and service so you know that you are in capable hands.

Reduced stress & time saving

Choosing the right financial product is time consuming and can be stressful, so remove much of this by putting it in the hands of one of our financial experts.

Reliable service

Whatever type of financial product or service you are looking for, our service is reliable and always matched to your own personal circumstances.

Finance Advice Centre Derby

Based on the outskirts of Derby, Finance Advice Centre is easily assessable with free parking facilities. The derby branch has been based at Raynesway since 2014 and is based within both a residential area and conveniently located at Prime Business Centre which is very near Asda in Spondon.

The business has grown from strength to strengths with many happy customer reviews which can be found on both Reviews.co.uk and Google. Our priority is to help find you the best deal and products for you, your family and your circumstances.

Originally from Australia, director Matt Cassar started his career as a professional cricketer. He represented both Derbyshire County Cricket Club and Northamptonshire County Cricket Club. After retiring from cricket Matt pursued a successful career in the financial services industry, incorporating his own business in 2006.

Finance Advice Centre has expanded extensively in the last few years with many experienced advisors able to help with all your Mortgage, Loan and Protection needs. Many of the franchises have advisors who originally trained with Matt himself. Due to their success at the Derby office, they progressed to setting up their own businesses trading as Finance Advice Centre.

Get in touch

Chatsworth House

Prime Business Centre

Raynesway

Derby

DE21 7SR

01332 821 340 or 0800 103 2655

Want to join the team?

Are interested in joining the Derby franchise? We are currently looking for advisors to join so if you’re interested feel free to get in touch here.

Where to Find us

Our Advisors

Jeanette Clark

Derby

Mortgage & Protection Advisor

Paul Clark

Derby

Mortgage & Protection Advisor

Jake Conners

Derby

Mortgage & Protection Advisor

Sarah Earnshaw

Derby

Mortgage & Protection Advisor

Suresh Gadher

Derby

Mortgage & Protection Advisor

Nick Gill

Derby

Mortgage & Protection Advisor

Steve Hatton

Derby

Mortgage & Protection Advisor

Jonathan Hunting

Derby

Mortgage & Protection Advisor

Harriette Milne

Derby

Mortgage & Protection Advisor

Michael Parsons

Derby

Mortgage & Protection Advisor

Ben Patten

Derby

Mortgage & Protection Advisor

Jason Pulsford

Derby

Mortgage & Protection Advisor

Virgil Stephens

Derby

Mortgage & Protection Advisor

Chris Towlson

Derby

Mortgage & Protection Advisor

Mark Wallbank

Derby

Mortgage & Protection Advisor

Some of the types of mortgages we can help you with

First-time buyers

There is a lot of exciting potential for first-time buyers in Derby looking for a new home. You may have spent the past few years saving up your deposit and now you want to get on the property ladder. If that is the case, the next step is to find out how much you are able to borrow so you can get a better idea of the type of property you can realistically afford to buy. When you start looking for mortgages in Derby be sure to shop around and compare the best deals. If you’re new to the market, it can be tempting to go with the first mortgage option you see for ease, but doing your research will pay off for you in the long run in getting a good value mortgage option.

Remortgaging your property

There are a number of reasons you might decide to remortgage your property including:

- Your current deal is due to expire soon

- Mortgage overpayments

- Increased property value

- You are on a higher interest rate

- Releasing of equity in the property

If you need any help with remortgaging it is advisable to speak to a mortgage broker in Derby. They will be able to answer any questions you have and ensure you get the best deal for your remortgage.

Buy-to-let mortgages

A buy-to-let mortgage is a mortgage specifically aimed at people who buy property as an investment rather than a home to live in. If you are planning on renting out a new property, the majority of lenders will prefer you not to finance the purchase with a normal residential mortgage.

The difference between a buy-to-let mortgage and a residential one is that unlike most residential mortgages, buy-to-let are usually offered on an interest-only basis. Therefore, your monthly payments will only cover the interest on your mortgage.

Right to Buy mortgages

If you are a council tenant, you may have the option to buy your property from your landlord at a discount through the Right to Buy scheme. How much discount you will get depends on whether you live in a house or a flat, in a house you get a 35% discount if you have been a tenant for between three and five years. After five years the discount goes up by 1% for every extra year you have been a tenant, up to a maximum of 70%. If you are in a flat, you get a 50% discount if you have lived there between three and five years and after that the discount rises by 2% for each extra year up to 70%.

Commercial Mortgages

Commercial mortgages usually carry on where business loans end. Business loans up to £25,000 are unsecured, but for greater amounts lenders require security so they can reduce the risk to themselves. A business mortgage typically lasts from 3 to 25 years and you can usually find a 70-75% mortgage. Mortgage loans for commercial properties fall into two categories, owner-occupier mortgages and commercial investment mortgages. The owner-occupier mortgage is used to buy property that will be used as trading premises for your business. Whereas commercial investment mortgages are used for property you are planning to let out.

For more information about mortgages in Derby get in touch with the Finance Advice Centre today. We also offer advice about self employed, moving home, professional, and Lifetime mortgages. Our team has specialist knowledge that can benefit you whether you’re completely new to the mortgage process or have been through it all before. So, if you are looking for a mortgage advisor in Derby that can give you the hand you need to get your mortgage application approved, we are here to help.

YOUR PROPERTY MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

Our approach - and how we do it

Enquire

We love speaking with our clients. Either give us a call or fill in one of our contact forms. Remember, we love a challenge!

Discuss

One of our Advisors will then find out what you’re looking to do, discuss your options and answer any questions you may have.

Relax

Your Advisor will find the best option for you and help arrange things. You then sit back and relax while we do the rest.

Ready to assist you.

Choosing a financial product or service, such as a mortgage, remortgage, loan or insurance can be daunting and your choice is a decision you need to get right. For this reason, it is vital that you get impartial advice from competent and qualified advisors. Whether you are a first-time buyer, looking to remortgage, hoping to remortgage or even buy a property to let, needing a loan or insurance this is where our advisers excel.

Be reassured that our aim is to guarantee reliable financial advice appropriate to any individual that makes contact with us. Through our network of contacts, we have access to thousands of financial products, from mortgages to loans to insurance, so we are confident that we’ll find one to suit you.

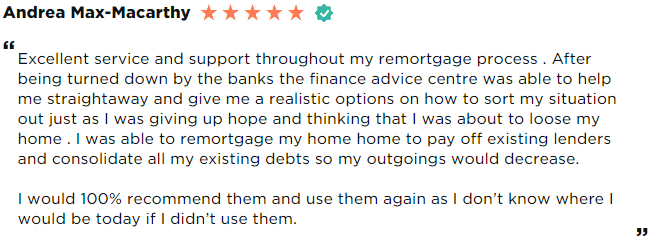

See what our customers think ...

Emma Griffiths

I would highly recommend the mortgage advice service Alice Hale was amazing throughout she is a credit to your organisation and helped us secure our dream home

Emma Weaver

We had a long journey buying our first home together and recent pandemic events didn’t help matters. Every step of the way, our advisor Steve was supportive, positive and we had every confidence in him. He was able to arrange a good deal for us and we were able to move into our dream house this autumn.

Joanne Widdowson

I used George from the finance advice centre to get my mortgage, and he was nothing but amazing! Talked me through every step, always easy to get hold of ! And got me a brilliant product I would highly recommend him, just brilliant 5 stars from me

What a Fantastic Service from start to finish. Great customer support from Ben Patten & Joe Frayne, superb product knowledge and exceptionally responsive to emails/calls, we can 100% recommend the Finance Advice Centre Ltd , they got us a great deal on a mortgage with suited life insurance, especially during this very difficult Covid 19 time ……

From start to finish, Greig and Emily were very helpful with our mortgage application. The advice Greig gave us was very clear and informed. They were always available either by phone or email to answer any questions we had. The whole process was made a lot easier because of the work they did. Would thoroughly recommend

Let us do the work of finding your mortgage

We’ll put you in touch with impartial advice from an expert mortgage advisor who will help secure you the best mortgage deals available.